The evolving U.S. trade policy landscape is reshaping global supply chains and introducing new complexities. We explore the wide-reaching effects of current tariffs, how Endries is responding with transparency and strategic sourcing, and what it means for our customers. Whether you’re in procurement, operations, or leadership, this offers valuable insight into a shifting environment – and how we’re working to deliver stability and value throughout.

By Michael Knight, President & CEO Endries International, Inc.

Understanding the Impact of Today’s Tariffs

The scope and complexity of the tariffs the new administration has enacted are unprecedented. A great many of Endries’ customer relationships go back decades and we have been through a lot together… recessions, pandemics, inflation, supply chain shocks… but nothing as disruptive and negatively impactful as these tariffs are proving to be.

Our goal as a trusted supplier of consumable materials for your production line has always been to make sure that you receive the right parts, at the right time, at the right price. In essence, our ambition is to deliver peace of mind at the best total cost of ownership to every one of our customers. The developing trade wars are a challenge to this ambition, and we are diligently working to navigate and mitigate for our customers.

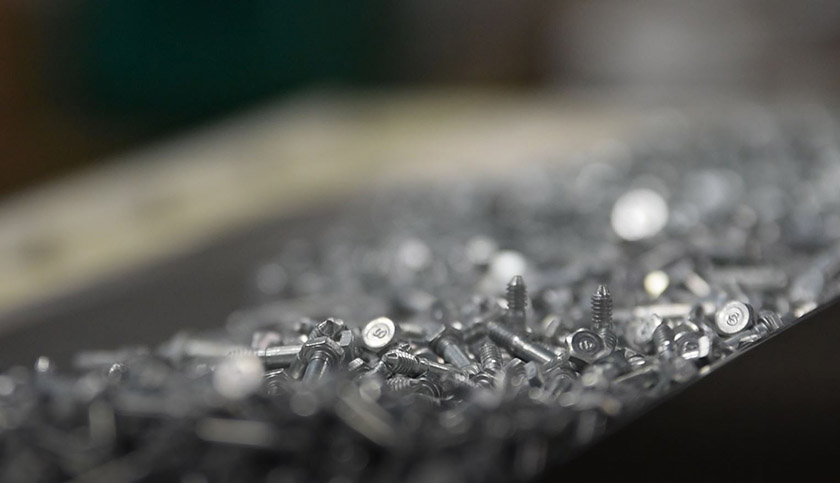

The majority of what we supply our customers are industrial fasteners, which are made of steel. According to Modor Intelligence, the metal fasteners market dominates the North American industrial fasteners market, commanding approximately 89% market share in 2024 [1]. The section 232 tariffs have added a 25% tax on everything made of steel (and aluminum) that was not smelted and poured in the United States, regardless of the country of origin [2]. For parts that we import, this tariff applies to the entire value of the import. For parts that we source domestically, the majority are made with steel from Canada and so the tariff is applied to the steel portion of those cost of goods sold, which for fasteners is a key cost driver.

For imported parts, the original section 301 tariff of 25% that has been in effect on almost everything we source and import from China [3]. China imports now also have two separate 10% tariffs and there is an additional 25% tariff planned on China because of their being a consumer of oil from Venezuela [4]. Simply put, cumulatively there is an 70% tariff on things made of steel (or aluminum) from China (25% + 25% + 10% + 10%), soon going to 95%. Parts made of steel or aluminum from other countries have a 35% tariff on them (25% + 10%).

| At this time, it is important to note that the reciprocal tariffs, whether those active for imports from China or those for imports from other countries that have been paused, do not apply to metal fasteners for which the above tariff scheme takes precedent. However, the reciprocal tariffs do apply to all other imports [5]. |

China and Taiwan are home to the biggest producers of industrial fasteners in the world [6]. Their investments in capacity and automation, and proximity to raw material providers, has long given them a significant cost advantage relative to U.S. producers, even with the cost of freight (for which the trend has been inflationary) and duties that average 6.0%. The cost position of China in particular, especially for things like standard hex nuts, washers, bolts screws, is such that even with the section 301 tariff that went in to effect in 2018, there was no advantage to moving production out of the country. Today, with a 70% tariff versus 35% from other countries, China is the most cost-effective source for many industrial fasteners. This is the current state of supply.

Providing Clarity in a Shifting Landscape

So, what are we doing about all of this? Let’s start with the “bottom line”. These tariffs add incremental cost that is simply too high to be absorbed by the supply chain [7]. The margins in each link of the supply chain have grown thin over time… something that happens with stability and growth in demand. Each link in the supply chain is in the same proverbial boat and is forced to pass along to the next link any tariff expense for which they are responsible. But how each link handles these tariffs will vary by supplier and circumstance.

At Endries, our preferred way of dealing with tariffs has always been as a tariff surcharge on the agreed to price of what we supply. When we are the importer of record the exact tariff amount is readily identifiable and trackable. In addition, our practice has been not to add the tariff to the final product resale. The tariff is on our cost, and we do not take this as an opportunity to enhance our selling margins. Further, we are sometimes able to negotiate with the producer a reduction in their price to us as an offset while the tariff is effect, which then our practice is to reduce the tariff percentage accordingly when calculating the surcharge for our customers.

| For reference, the compounding 70% tariff on Chinese steel, aluminum, and derivatives dampened Chinese producers’ willingness to help absorb the import tariff impact on their customers, and the massive reciprocal tariffs placed on all Chinese goods have completely shut that door [8]. |

Dealing With Tariff Surcharges

1. The Tariff Surcharge Method

The tariff surcharge method is the fairest and most transparent way of dealing with a trade related expense. As we have seen, tariffs can be flipped on and off like a light switch, and related costs should be as well. Our commitment to our customers is that the day the tariff is removed, any tariff related cost that we apply will be removed. Another benefit to the surcharge method is that the customer’s price for the imported parts that we supply remains consistent with our agreement, so their internal purchasing metrics are not affected by the tariffs.

While the tariff is in place, we invoice for it as a separate line item, usually at the end of a month which provides some cashflow relief for our customers. We have systematized this using tables in our ERP that track all applicable tariffs by part number, harmonization code, and county of origin. With over 100,000 sku’s that we supply being subject to a tariff, our system enables us to do what would likely be impossible if we were to attempt to calculate and apply tariff surcharges manually.

2. Add Incremental Cost To The Cost of Goods Sold

The other common method of tariff recovery is to add the incremental cost to the cost of goods sold. In the case of parts produced in the U.S. from foreign steel or aluminum, this is logical as the tariff the producer is paying is on a raw material input. In some cases, a company other than Endries is the importer of record and so they pay the tariff. These companies are generally aggregators of demand for high mix, small volumes of common parts that get sold to multitudes of end customers. In these instances, the tariff cost is added to cost of goods sold. In all cases, a markup is applied to preserve target gross margins, and this new price becomes our buy cost.

In these cases, because of the extremeness of the cost impact, we are unable to fully absorb the price increase and so will need to implement a price increase for the affected parts. Our practice here is to blunt the effect where we can, and our system keeps track of those parts whose price has increased due to tariffs so that if and when the tariff is removed, we can make sure that our supplier rolls back their price to us, and that we reset our price to the customer.

Alternative Sources From Countries with Lower Tariff Rates

The next thing we are doing is looking for alternative sources producing in countries that have the lowest effective tariff rates. To that end, we have built a basket of parts that represent the majority of what we supply and have negotiated pricing and delivery with legitimate alternative producers. The net result is that due to the amount and way in which the tariffs are applied, there are two basic scenarios:

- Moving parts out of China to other foreign sources

- Moving foreign sourced parts to a U.S. producer. The objective in both scenarios is to source parts with the lowest applied cost (price + tariffs and duties + logistics).

Our analysis has determined that some Chinese parts can be shifted cost effectively to other foreign producers, primarily based in Taiwan, India, and Vietnam. As mentioned, there are still many commodities that even with the high tariffs, China is the most cost-effective source available [9]. That said, given the rising tensions between the U.S. and China and the apparent unwillingness for either side to de-escalate, regardless of cost the best strategic course of action may prove to be moving all possible sourcing out of that country. For non-China parts, we have found some instances of parts that based on current market costs can be cost effectively migrated to a U.S. based producer.

For those parts that can be cost effectively moved, the next challenge the industry has is capacity. The fact is that today capacity is finely balanced in accordance with longstanding supply chain configurations. Simply put, other countries do not have the capacity to absorb everything now made in China. In the U.S., the capacity situation is the same in that production has been capped at traditional demand and there is very little free capacity available [10]. In fact, we are already seeing notable lead time increases in the U.S. and all other countries, both in the time it takes to get a quote, and the delivery time for ordered parts.

While this is an opportunity for any producer outside of China to increase their market share, there is a notable reluctance to make the necessary investments in capacity expansion. Beyond the capital expenditures, there is the issue of lead times for new equipment and facility expansion, plus challenges with staffing and training. The uncertainty around the durability of the current tariff policies adds to the difficulty in what would otherwise be a basic business decision to invest in incremental capacity and gain market share.

The long and short of it is there are no easy solutions. The decision on whether or not to source material from China is more strategic than economic for many categories of industrial fasteners. As a leading supplier of fasteners and other c-class components to leading original equipment manufacturers, Endries is first and foremost committed to being transparent on how we deal with the added costs of al tariffs. Second, we are applying our decades of product expertise and knowledge of the domestic and global producers and markets to find tailored supply chain solutions for each of our customers that give them the best combination of assured supply and optimized delivered price, to customer and/or industry specification, or better.

Updated April 16, 2025

Sources:

[1] https://www.mordorintelligence.com/industry-reports/north-america-industrial-fasteners-market

[2] https://www.bis.doc.gov/index.php/232-steel

[3] https://ustr.gov/issue-areas/enforcement/section-301-investigations/tariff-actions

[4] https://www.whitehouse.gov/presidential-actions/2025/03/imposing-tariffs-on-countries-importing-venezuelan-oil/

[5] https://www.reuters.com/markets/china-urges-us-cancel-reciprocal-tariffs-2025-04-03/

[6] https://www.fastener-world.com/data/pdf_download/FW_178_E_237.pdf

[7] https://taxfoundation.org/blog/who-pays-tariffs/

[8] https://www.cnbc.com/2025/04/11/how-chinas-exporters-are-scrambling-to-mitigate-the-impact-of-punishing-us-tariffs-.html

[9] Endries internal sourcing and pricing study conducted in March 2025

[10] https://www.federalreserve.gov/releases/g17/current/table1c_sup.htm